Environmental, Social, and Governance (ESG) factors have become increasingly significant in the realm of investment funds. Investors are progressively recognizing that companies adhering to strong ESG principles are not only contributing positively to society and the environment but also tend to exhibit better long-term financial performance.

ESG-focused investment funds evaluate companies based on their sustainability practices, social impact, and governance standards, integrating these criteria into their investment strategies. This approach helps in identifying companies that are well-managed, ethical, and sustainable, thereby reducing risks associated with environmental liabilities, social controversies, and governance issues.

Additionally, ESG investment funds are attractive to a growing segment of investors who are keen on aligning their investment choices with their personal values, ultimately driving a shift towards more responsible and ethical investing practices. As a result, ESG investment funds are not only fostering sustainable development but are also proving to be a prudent choice for forward-thinking investors aiming for robust financial returns coupled with positive societal impact.

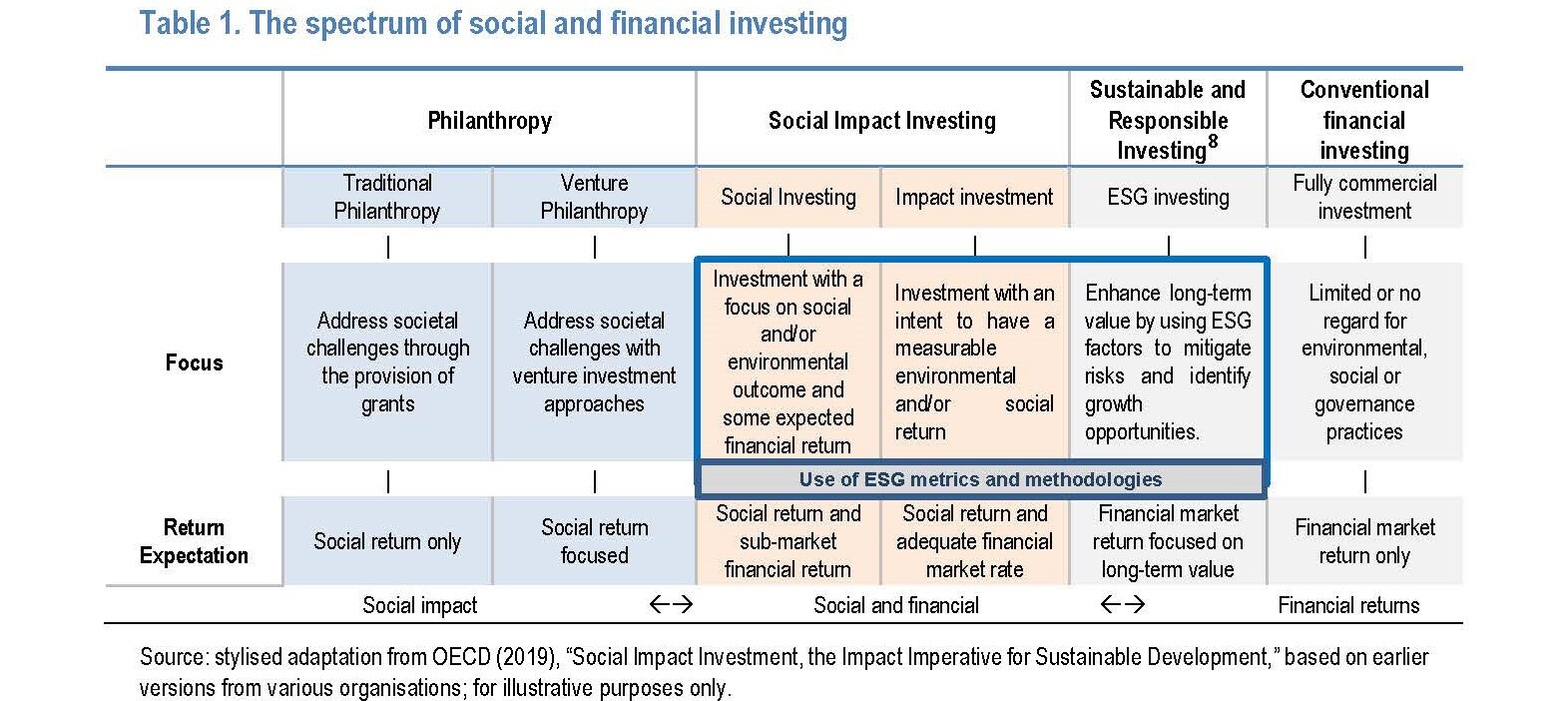

Positioned between the extremes of philanthropy and conventional financial investing, ESG-focused investments exemplify the blend of financial returns with social and environmental impact, embodying the evolving landscape where profit and purpose coexist.

ESG Funds

The spectrum of social and financial investing encompasses a wide range of strategies that blend traditional financial goals with social and environmental impact. At one end of this spectrum lies philanthropy, where the primary objective is to address social issues without expecting financial returns. On the opposite end is conventional financial investing, which focuses solely on maximizing financial returns. Between these two poles are social impact investing and sustainable, responsible investing, which seek to achieve both financial and social objectives. Social impact investing targets specific social outcomes while aiming for financial returns, whereas sustainable investing integrates Environmental, Social, and Governance (ESG) metrics and methodologies to identify investments that are both profitable and aligned with broader ethical standards.

ESG Funds & Investment Approaches

ESG funds are portfolios of equities and/or bonds that incorporate environmental, social, and governance factors into the investment process. These funds are designed to achieve both financial returns and positive societal impact by integrating ESG criteria throughout their investment strategies.

There are several distinct approaches to creating ESG funds, including:

- Screened exclusion

- Norms- based

- ESG Re-balancing

- Thematic focus

- Impact focus

- ESG Integration

Screened Exclusion

Negative screening is one of the oldest and most popular approaches to Environmental, Social, and Governance (ESG) investing. This method is ideal for investors who wish to take a moral stand by excluding certain sectors, such as the tobacco industry or oil extraction companies, from their portfolios.

For instance, a negative screen might exclude the highest greenhouse gas emitters from an investment portfolio. This approach has roots in faith-based investing, where investors avoid or divest from companies engaged in activities deemed incompatible with their beliefs or values. Negative screening allows investors to align their investments with their ethical standards while potentially reducing exposure to companies with significant ESG risks.

Norms Based Investment Approach

Also known as “inclusionary screening,” this approach seeks to include or give higher representation to issuers that comply with international norms. This method can involve “best in class” investing, where firms that exceed certain ESG score thresholds are selected for inclusion. Companies that meet these ESG criteria may align with general targets such as the United Nations’ Sustainable Development Goals (SDGs) or focus on specific areas like climate change or human rights. The inclusion approach is well-suited for investors who want to fund companies that make a positive impact on ESG factors, ensuring their investments contribute to sustainable and ethical practices.

ESG Re-balancing

Rebalancing a portfolio involves shifting exposures towards issuers with higher ESG ratings and away from those with lower scores. Funds can either align with an ESG-focused index for passive investing or engage in active investment strategies to tilt the portfolio according to the manager’s insights and perceived value opportunities.

An ESG-aware portfolio often needs to meet various objectives and constraints beyond merely enhancing exposure to specific ESG criteria. For instance, ESG-focused investors might also aim to:

- Track a relevant benchmark.

- Control for unintended industry and risk factor exposures.

- Target specific ESG issues.

- Manage overall risk levels effectively.

Thematic focus

ESG thematic strategies centre on one or more of the Environmental, Social, or Governance dimensions. These strategies can be driven by financial goals, values, or a combination of both. Thematic funds may not solely rely on overall ESG scores for exclusions or rebalancing; instead, they often focus on specific pillar scores and underlying metrics, such as environmental scores and carbon footprint intensity.

Such thematic funds may align with particular social standards and objectives. This approach can blur the lines between financial and social investing, as the thematic focus often prioritizes a purpose that extends beyond maximizing long-term financial returns.

Impact focus

Impact focus approach targets investments that generate measurable social or environmental impacts alongside financial returns involves a dual emphasis on achieving tangible positive outcomes and delivering financial performance. Example: To invest in renewable energy projects that reduce carbon emissions while generating competitive financial returns.

ESG Integration

ESG integration involves systematically and explicitly incorporating environmental, social, and governance (ESG) risks and opportunities into every aspect of an institutional investor’s investment process. Unlike the best-in-class approach, which often benchmarks against peer groups and may involve overweighting leaders or underweighting laggards. ESG integration approach evaluates ESG factors throughout asset selection, portfolio balancing, and risk management. This approach ensures that ESG considerations are embedded directly into the investment decision-making process, rather than relying solely on comparative performance metrics.

Four stages of ESG Integration:

Stage 1: Qualitative analysis – Investors will gather relevant information from multiple sources (including but not limited to company reports and third-party investment research) and identify material factors affecting the company.

Stage 2: Quantitative analysis – Investors will assess the impact of material financial factors on securities in their portfolio(s) and investment universe and adjust their financial forecasts and/or valuation models appropriately.

Stage 3: Investment decision – The analysis performed in stage 1 and stage 2 will lead to a decision to buy (or increase weighting), hold (or maintain weighting) or sell (or decrease weighting).

Stage 4: Active ownership assessment – The identification of material financial factors, the investment analysis and an investment decision can initiate or support company engagements and/or inform voting.

The additional information gathered and the outcome from engagement and voting activities will feedback into future investment analysis, and hence have an impact of subsequent investment decisions.

This approach involves analyzing financial information and ESG information; identifying material financial factors and ESG factors; assessing the potential impact of material financial factors and ESG factors on economic, country, sector, and company performance; andmaking investment decisions that include considerations of all material factors, including ESG factors.

Conclusion

Each approach supports broader goals of sustainable development by addressing key global challenges. These diverse approaches enable investors to align their portfolios with their values and contribute to sustainable development while seeking competitive financial returns.The combination of aligning with values, supporting sustainable development, and aiming for financial success creates a holistic investment strategy that meets both ethical and financial objectives.