The Business Responsibility and Sustainability Reporting is a sustainability disclosure in India that includes the initiatives a company has taken on its Environmental, Social, and Governance parameters (ESG).

It is a reporting format which requires top 1,000 listed entities to file BRSR as part of the Annual Report with SEBI from FY 2022-23 onwards.

- It is a mandatory disclosure for the top 1,000 listed companies (by market capitalisation) recognized by the Securities Exchange Board of India (SEBI).

- Companies must submit this information as a part of their annual report.

- The disclosures should be in the format prescribed by SEBI.

- This ensures investors have access to standardized disclosures of a company’s ESG performance.

Evolution of ESG Regulatory Reporting

The evolution of ESG regulatory reporting in India has been marked by a progressive shift towards more comprehensive and stringent requirements, reflecting the global trend towards sustainability and responsible business practices. Initially, ESG considerations in India were driven by voluntary guidelines and frameworks such as the National Voluntary Guidelines on Social, Environmental, and Economic Responsibilities of Business (NVGs) introduced in 2011.

These guidelines set the stage for more formalized reporting with the advent of the Business Responsibility Reporting (BRR) framework mandated by the Securities and Exchange Board of India (SEBI) in 2012 for the top 100 listed companies. Recognizing the increasing importance of ESG factors in investment decisions and corporate governance, SEBI expanded the BRR requirement to the top 1,000 listed companies by 2019. The most significant leap came with the introduction of the Business Responsibility and Sustainability Report (BRSR) in 2021, which enhanced the depth and breadth of ESG disclosures, making them more quantifiable and aligned with international standards. (Refer Figure-1). This regulatory evolution signifies India’s commitment to integrating sustainability into the corporate ethos, encouraging businesses to adopt more transparent and accountable practices.

This article outlines the Indian regulatory reporting requirements and includes the revisions made to the Business Responsibility and Sustainability Report (BRSR) in 2023.

Figure 1

National Guidelines on Responsible Business Conduct (NGRBCs)

The Business Responsibility and Sustainability Report (BRSR) is founded on the nine principles outlined in the National Guidelines on Responsible Business Conduct (NGRBCs). These principles serve as a comprehensive framework designed to guide businesses in adopting and integrating responsible and sustainable practices into their core operations.

The Nine Principles of the National Guidelines for Responsible Business Conduct (NGRBCs) are as follows:

- Integrity and Transparency: Businesses should conduct and govern themselves with integrity, and in a manner that is ethical, transparent, and accountable.

- Product Lifecycle Sustainability: They should provide goods and services that are safe and contribute to sustainability throughout their life cycle.

- Employee Well-being: Organizations should promote the well-being of all employees, ensuring fair treatment, non-discrimination, and respect for their rights.

- Stakeholder Engagement: Businesses should respect the interests of, and be responsive to, all stakeholders, especially those who are disadvantaged, vulnerable, and marginalized.

- Human Rights: They should respect and promote human rights across their operations and value chain.

- Environment: Businesses should respect, protect, and make efforts to restore the environment.

- Public and Regulatory Policy: Organizations should conduct themselves in a manner that is responsible and accountable, supporting inclusive growth and equitable development.

- Inclusive Growth and Development: They should promote inclusive growth and equitable development, contributing to the economic and social development of communities and regions.

- Customer Value: Businesses should engage with and provide value to their customers and consumers in a responsible manner, ensuring that their goods and services meet quality standards and are not harmful to society or the environment.

The BRSR framework, based on these principles, aims to ensure that companies not only comply with regulatory requirements but also contribute positively to society and the environment, fostering long-term sustainability and responsible business conduct.

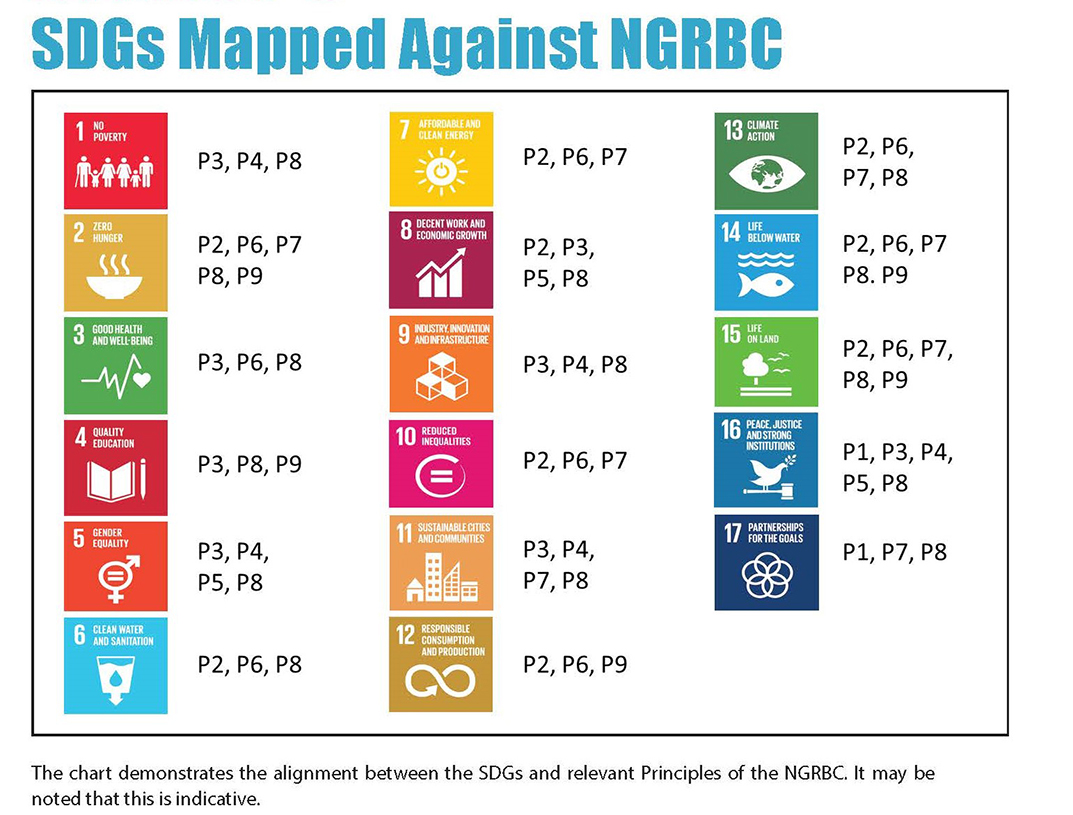

Alignment of NGRBCs with SDGs

The National Guidelines on Responsible Business Conduct (NGRBCs) are closely aligned with the United Nations Sustainable Development Goals (SDGs), reflecting a commitment to promoting sustainable and inclusive growth. Each of the nine principles of NGRBCs corresponds to specific SDGs, creating a coherent framework that encourages businesses to contribute to global sustainability targets.

For instance, principles related to integrity, transparency, and human rights align with SDG 16 (Peace, Justice, and Strong Institutions), while those focusing on environmental protection and product lifecycle sustainability correspond to SDG 12 (Responsible Consumption and Production) and SDG 13 (Climate Action). Principles advocating for employee well-being and stakeholder engagement resonate with SDG 8 (Decent Work and Economic Growth) and SDG 10 (Reduced Inequalities). (Refer Figure-2)

By embedding these principles into their operations, businesses not only adhere to national guidelines but also play a crucial role in achieving the broader objectives of the SDGs, fostering an ecosystem where economic growth is balanced with social equity and environmental stewardship. This alignment underscores the integrative approach of NGRBCs in driving sustainable business practices that support the global agenda for a more equitable and sustainable future.

Figure 2

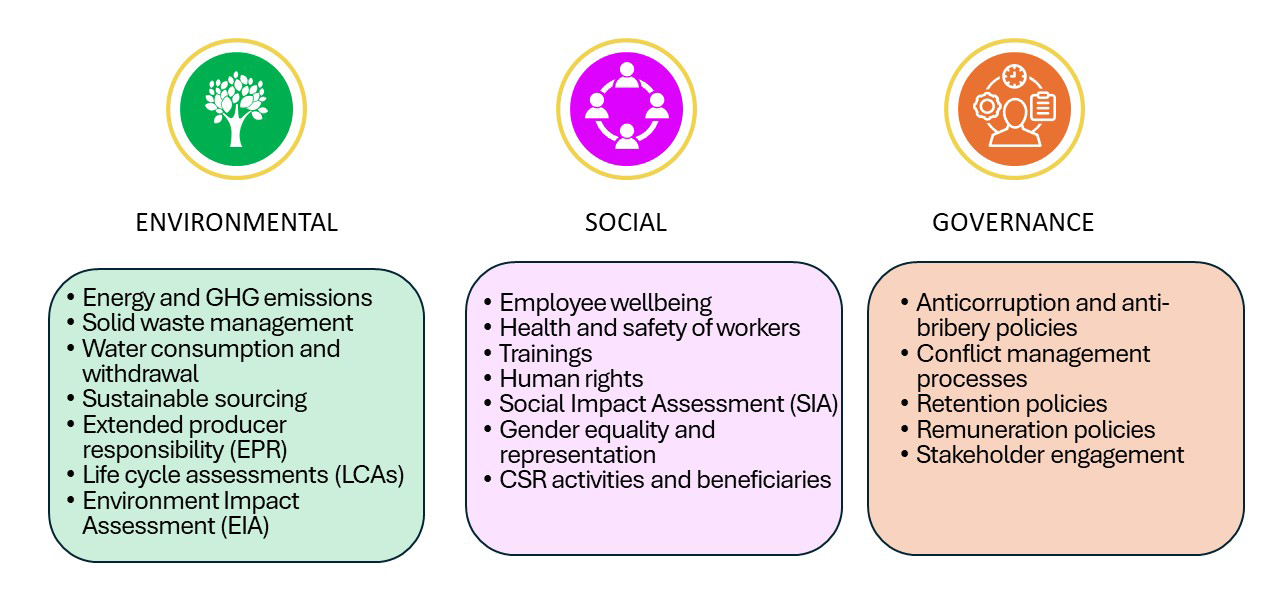

BRSR and ESG

The BRSR Key Performance Indicators are meticulously designed to capture the essence of ESG dimensions, ensuring that companies provide detailed and quantifiable disclosures on their sustainability performance.

On the environmental front, KPIs focus on metrics such as energy consumption, greenhouse gas emissions, water usage, and waste management, directly aligning with environmental stewardship. Social KPIs encompass aspects like employee well-being, diversity and inclusion, community engagement, and human rights, thereby addressing the social responsibilities of businesses. Governance KPIs emphasize transparency, ethical conduct, board diversity, and risk management, reflecting the core principles of robust corporate governance. (Refer figure- 3)

By aligning BRSR KPIs with ESG criteria, the reporting framework not only enhances the comparability and transparency of sustainability reports but also enables investors and stakeholders to make informed decisions based on standardized and reliable data. This alignment reinforces the commitment of Indian businesses to integrate ESG considerations into their strategic and operational frameworks, driving long-term value creation and sustainability.

Figure 3

BRSR Format

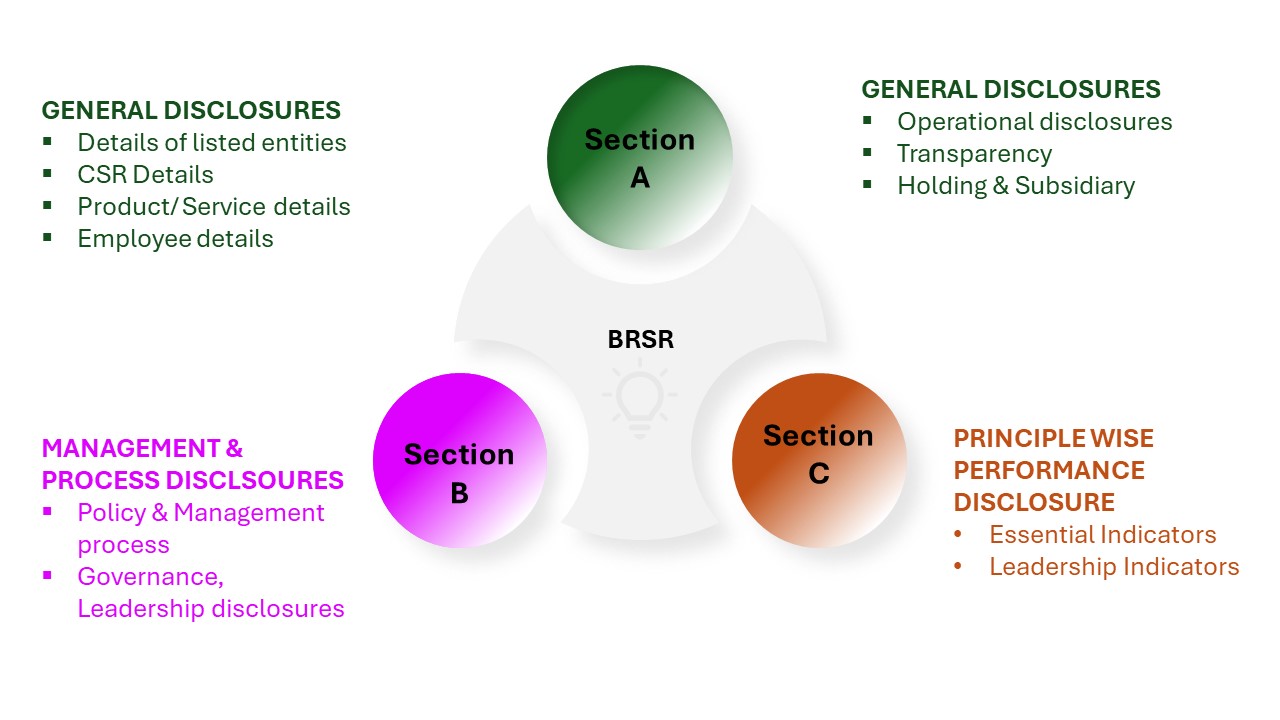

The Business Responsibility and Sustainability Report (BRSR) format is a standardized framework/ template designed to help companies in India disclose their sustainability and social responsibility initiatives.

Figure 4

BRSR Updates in 2023

Subsequently, in June and July 2023, SEBI further amended the BRSR requirements.

Revised BRSR Framework

The revised BRSR framework as the previous format has Three Reporting Sections based on the NGRBCs: General Disclosures, Management and processes and Principle wise performance. BRSR updated format includes few new requirements under different principle wise disclosure like:

- Details of spending towards wellbeing of workers,

- % comparison of gross wages of the workers,

- Energy intensity, Water intensity and Emissions intensity is now required to be on the per rupee of turnover adjusted for Purchasing Power Parity (PPP). While no defined measurement for PPP has been laid down. World bank PPP Estimation and Calculation tool can be used.

- While few other requirements that were leadership indicators i.e. voluntary in the previous format have now been made mandatory. For example: Details related to water discharged for the current and previous financial year, Information relating to data breaches

- Total Mandatory indicators: 106 (98 earlier).

- Leadership indicators: 39 (42 earlier) These indicators are both qualitative and quantitative in nature.

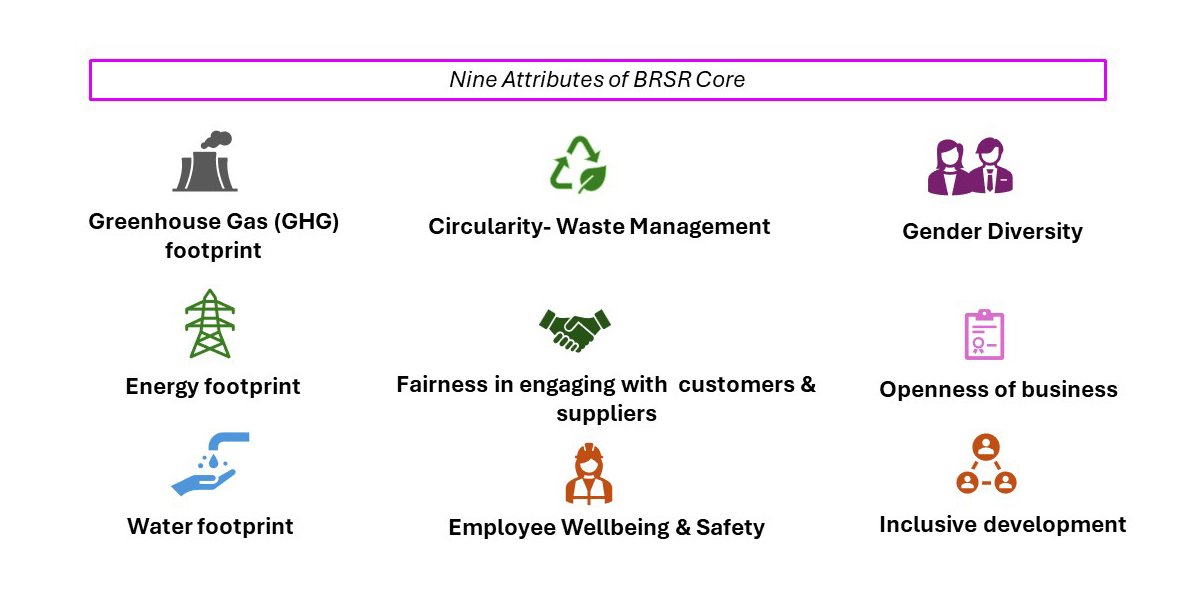

Introduction of BRSR Core

BRSR Core is a sub-set of the SEBI BRSR format. The BRSR Core consists of a set of nine attributes and corresponding parameter, measurement and data and assurance approach. (Refer fig.-5). The top 1,000 listed entities (by market capitalisation) are required to provide the BRSR Core disclosures as part of the annual report from FY 2023-24.

Figure 5

BRSR Core for value chain

The updated BRSR framework provides that a listed entity should report the parameters as per BRSR Core for their value chain to the extent it is attributable to their business with that value chain partner.

- Applicability:

The ESG disclosures for the value chain is applicable to the top 250 listed entities (by market capitalisation), on a comply-or-explain basis from FY 2024-25. - Reporting format:

Disclosures for value chain should be made by the listed entity as per BRSR Core, as part of its annual report. - Composition of value chain:

- Value chain should encompass the top upstream and downstream partners of a listed entity, cumulatively comprising 75 per cent its purchases/sales (by value) respectively.

- Such reporting may be segregated for upstream and downstream partners or can be reported on an aggregate basis.

- Scope of reporting and any assumptions or estimates, if any, should be clearly disclosed.

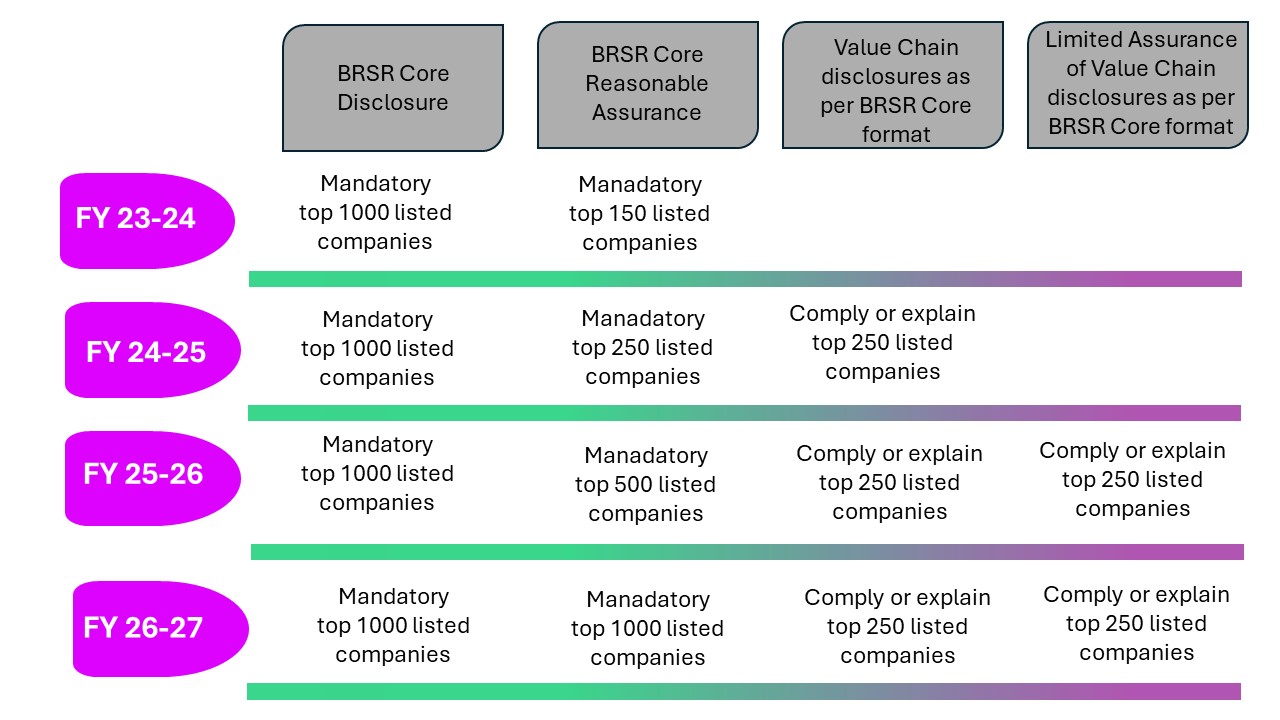

BRSR Assurance

Reasonable assurance on BRSR Core is mandatory for top 150 companies (as per market capitalisation) from FY 2023-24. Subsequently, SEBI circular mandates more companies to be brought under the scope of reasonable assurance in the following years.

Limited assurance for BRSR Core value chain disclosures applicable to the top 250 listed entities (by market capitalisation), companies should obtain limited assurance on a comply or-explain basis from FY 2025 – 26.

Requirements for Assurance Provider

- Expertise: The Board of the listed entity should ensure that the assurance provider of the BRSR Core has the necessary expertise, for undertaking reasonable assurance.

- Independence: The listed entity should ensure that there is no conflict of interest with the assurance provider appointed for assuring the BRSR Core disclosures. For instance, it should be ensured that the assurance provider or any of its associates do not sell its products or provide any non-audit/non-assurance related service including consulting services, to the listed entity or its group entities.

The timelines for all the BRSR updates and disclosures are provided below:

BRSR and Impact on MSMEs

The Business Responsibility and Sustainability Report (BRSR) format, while primarily targeting larger corporations, has significant implications for Micro, Small, and Medium Enterprises (MSMEs) in India. With the introduction of BRSR Core in value chain the expectations from the MSMEs to follow and provide ESG data is ever high. Here are a few key points on how BRSR impacts MSMEs:

Supply Chain Pressure: MSMEs often form part of the supply chains for larger companies required to comply with BRSR. Consequently, these larger companies may expect their MSME partners to adhere to similar sustainability and responsibility standards, indirectly driving MSMEs to adopt ESG practices.

Market Access and Competitiveness: MSMEs embracing ESG principles and aligning with BRSR requirements can gain a competitive edge, potentially opening up new market opportunities and partnerships with sustainability-conscious businesses and investors.

Resource Constraints: Unlike large corporations, MSMEs may face challenges in terms of resources and expertise to implement and report on ESG practices. The BRSR framework’s requirements could thus be burdensome, necessitating capacity building and support.

Financial Opportunities: Compliance with BRSR principles can enhance the credibility of MSMEs, making them more attractive to investors and financial institutions that prioritize ESG criteria, potentially improving access to funding.

Long-term Benefits: By integrating ESG practices, MSMEs can achieve operational efficiencies, better risk management, and improved brand reputation, contributing to long-term sustainability and growth.

Preparedness:

- The value chain partners of the top listed companies would need to maintain and provide data in relation of the ESG disclosures.

- Therefore, value chain partners to develop necessary processes, to train, and collect data for the ESG disclosures.

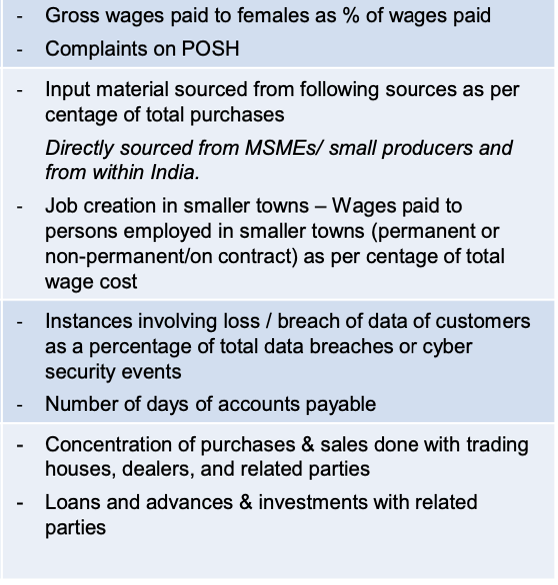

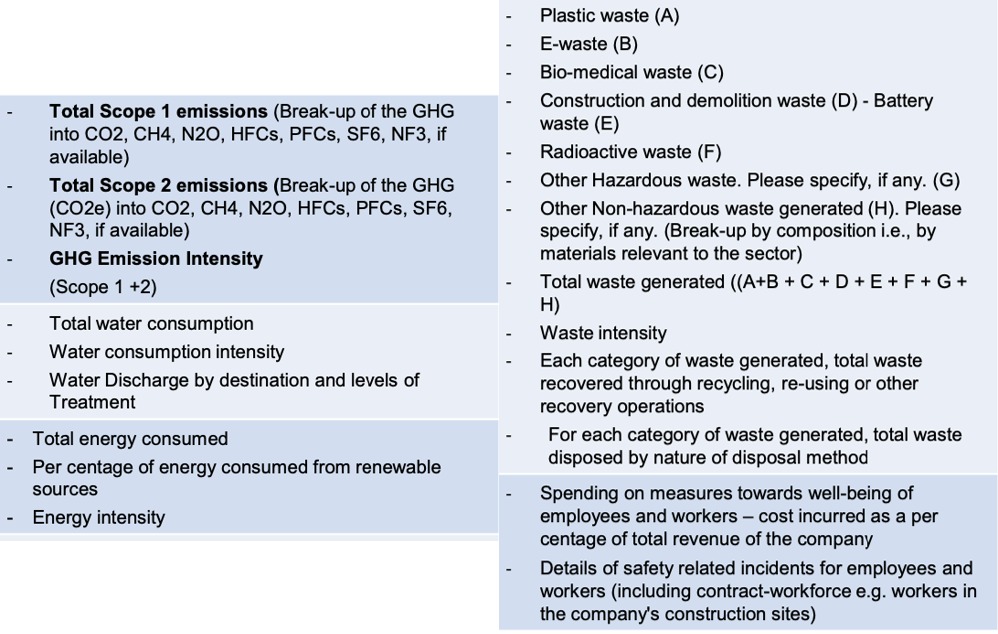

- Few Social and Environment parameters that the SMEs should start collating are provided below: